Employee Ownership Trust

Employee Ownership Trusts or EOTs are a unique way to sell or transfer a business into an employee-owned model with shares held in a trust on behalf of and for the benefit of all the employees.

25 years' experience in employee ownership trust and third party sale transactions, helping business owners realise the value in their businesses. Contact Richard: 020 8949 5522 / enquiries@rm2.co.uk

Richard Cowley

Corporate Finance DirectorWhat is an Employee Ownership Trust (EOT)?

The Employee Ownership Trust (EOT) offers a highly tax efficient way for a company’s owner to sell a controlling stake of a business to its employees and place the business into the indirect ownership of employees to become an employee-owned business (EOB). This is often used as part of an exit or succession strategy for the business owner.

The EOT was created by the government in 2014 to encourage employee ownership as a structure to hold shares in a company on behalf of all the employees. Shares in the company are held within a Trust as a clear framework for employee ownership for the benefit of all the company’s employees.

The transaction provides significant tax advantages for the seller to pay no capital gains tax and allows the business to pay annual tax free bonuses to employees of up to £3,600 per employee.

The trust has a number of Trustees whose role is to represent the interests of employees. The trustees are not responsible for the day to day running of the company – that remains the responsibility and role of the board of directors. However, trustees can oversee the management and leadership of the company and may interject if management are not considered to be acting in the best interests of employees as a whole.

Download Free EOT Fact Sheet

How do Employee Ownership Trusts work?

To set up an Employee Ownership Trust (EOT), the shareholders in the company will need to transfer a majority of the business’s shares into the trust. As a result, the EOT must have a controlling interest in the company of greater than 50%, including all share rights such as rights to votes, dividends and capital.

After the sale, the EOT then holds those shares for the benefit of all of the company’s employees (excluding, broadly, individuals who hold, or have previously held, 5% of the shares in the company).

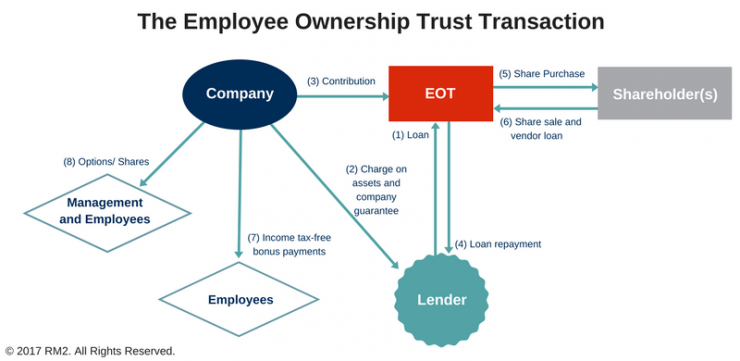

The basic process to set up an EOT involves:

- The company is valued for the purposes of the EOT transaction;

- The EOT borrows money from the seller/s (vendor loan) with/without third party financing & with a company guarantee;

- The lenders take a charge over the company’s assets;

- The shareholders sell between 51% and 100% of the shares to the EOT for cash and a vendor loan note. Sellers pay no Capital Gains Tax on the shares sold in the year the EOT acquires the shares;

- The EOT pays for the shares with cash and vendor loans;

- The loan due to the seller/s from the EOT is repaid over time using contributions from post-tax profit made to the trust by the company;

- As an incentive to align interests, the company may issue shares or options to key managers and employees; the EOT must always hold the majority of shares; and

- Employees are eligible to receive income tax-free bonus payments up to £3,600 per employee per annum; bonuses are not mandatory.

What are the tax benefits of an Employee Ownership Trust?

EOTs deliver two main tax benefits:

Capital Gains Tax relief – Individuals who sell to an EOT benefit from 100% relief from Capital Gains Tax (CGT) that might otherwise be paid, provided they have sold a controlling stake in the business. This can therefore significantly increase the effective value of the sale to the outgoing shareholders.

Income Tax free bonus – Companies owned by an EOT can pay each employee an annual bonus payment of up to £3,600 free from income tax. The bonuses are subject to National Insurance Contributions.

Download Free EOT Fact Sheet

How is an EOT funded?

The most common way to fund an EOT transaction is:

- The EOT borrows money using a loan from the outgoing business owner, supported by a company guarantee. Third party financing can also be used.

- The lender takes a charge on the company’s assets.

- The company makes contributions to the EOT to pay interest and fees and to repay the loan (this must be a contractual obligation).

- The loan to the EOT is repaid over time from the future post-tax profits of the business.

If the company has cash reserves at the time of the sale, it is common for an initial cash payment to be made as part of the transaction.

Both the initial cash payment and the loan are exempt from capital gains tax (see What are the tax benefits of an EOT?)

What are the benefits of Employee Ownership Trusts?

Selling your business to an Employee Ownership Trust (EOT) can offer a variety of benefits to the sellers, the employees and the business as a whole.

Selling your business to an Employee Ownership Trust offers several benefits for business owners looking for an exit strategy, including:

It is a tax-efficient way to sell a business – If certain conditions are met, transferring the controlling stake in a business into an Employee Ownership Trust can provide relief to the seller from any Capital Gains Tax (CGT) that would otherwise be due on the sale. This can make the sale significantly more valuable to the outgoing owners.

Securing the future of your company – If you have spent years building up your business, you will no doubt want to see it and the team you have put together continue to thrive and grow. Placing your company into an Employee Ownership Trust can help to protect the business and its employees for the future. You can control the timing of the transaction and any succession plan.

Stay involved after the sale – Sellers can retain a minority stake in the business after a sale to the EOT, if they wish. Alternatively, even if they have sold all their shares, they can stay involved in the business. This might include retaining a seat on the board of directors, or acting as a consultant, which means they can provide support and expertise to the new leadership team without being involved in the day-to-day running of the company. This can be particularly attractive if the sale proceeds are to be paid off over time out of the company’s post-tax profits.

Complexity and timescale – The transaction is non-adversarial. There are no third-party negotiations as it is effectively an internal transaction which is normally quicker and much less disruptive than a traditional trade sale or management buyout.

Achieving a smooth succession – Placing a business into an Employee Ownership Trust can allow for a gradual, carefully planned and managed transition, helping to keep the business running effectively on a day-to-day basis during the transition.

Keeping the previous owners’ experience and expertise – It is common for outgoing owners to continue working in the business, at least during an initial transition period, even if they have sold all of their shares. They might, over time, reduce their role in the company. This can allow the business to continue benefiting from their knowledge, skills and personal connections.

Increasing employee engagement – By giving employees a real stake in the business, placing a company into employee ownership can massively boost employees’ sense of connection to the business, leading to greater employee engagement, productivity and loyalty. Recent research (People Powered Growth 2023) looked at companies with a significant level of employee ownership – Employee Owned Businesses, or EOBs. The research found that these companies were 8-12% more productive than non-employee owned businesses. EOBs also reported increased profits, with 25% of EOBs more likely to have seen profits increase in the last five years than non-EOBs.

Business resilience – The same report showed that employee-owned businesses are over 50% more likely to expand their workforce than non-EOB companies and have been less likely to see profits decline, including through the recent pandemic (14% vs 25%). Employees in EOBs were five times less likely to face redundancy in the three years before the report in comparison to non EOBs.

Working for a business that is controlled by an Employee Ownership Trust offers a number of benefits, including:

Seeing the financial benefits of the company’s success – Each employee can receive a bonus of up to £3,600 per year income tax-free, allowing workers to see a direct financial benefit when their hard work leads to increased profits for the business.

Although the EOT holds shares for all employees, it is possible for key managers and employees to receive differential rewards, just as they would in any other company. This might include paying discretionary bonuses or putting in place direct share incentive arrangements for staff. Direct share ownership arrangements in an EOT company – for example, Enterprise Management Incentive options – can deliver additional financial reward by way of dividends, and can also create individual wealth if an internal share market is set up (for example, by using an Employee Benefit Trust as a market for the shares). For more information see Hybrid Ownership

Maintaining the company’s independence – When a business is sold, this can often lead to significant uncertainty for the employees, including the prospect of redundancies, as well as concerns over the way the culture or values of a business might change. Employee ownership can be a way of allowing a company to stay independent and avoid these issues.

Increased engagement and motivation – 73% of businesses have reported increased job satisfaction with 83% reporting increased employee engagement and motivation since adopting the EO model (source People Powered Growth 2023)

Why would I consider selling to an Employee Ownership Trust?

An EOT can be a good choice for many types of businesses under various circumstances, including where:

- You are looking for a smooth exit strategy that protects your legacy and your employees

- You can’t find the right trade sale or management buyout solution

- You are the employees of a business and want to find a way to buy out the owners for everyone’s benefit.

Our specialist team can talk you through whether an EOT is right for your business. To set up a confidential call, email us on enquiries@rm2.co.uk.

How RM2 can help you

RM2 are true specialists – we focus entirely on employee share ownership, in all its forms, and we’ve been doing this for over 25 years. We have advised over 1,500 clients on their employee ownership solutions and established over 110 Employee Ownership Trusts since their introduction in 2014. Our experienced team is here to help you make the right informed choice, walking you through the steps necessary to tailor the right employee ownership solution for you and your business.

Our EOT advisory service includes the following:

Feasibility study: This will demonstrate how an EOT can work for your company and will help you form a view of the fair value of your company, how the financing would be structured, and how quickly you can expect to be paid.

Once your feasibility study has been completed, it is up to you to decide if an EOT is right for you.

EOT Transaction: If you decide to proceed, we can help with the full transaction including preparing the legal documents, managing the clearance process with HMRC, arranging for a formal valuation to be prepared, and project management throughout.

Hybrid Ownership: If required we can also help you implement an employee share plan to incentivise and reward key people, or give all employees a greater feeling of ownership and sense of community dependent upon the share plan chosen. Take a look at what Hybrid Ownership involves.

Post-transaction compliance and support: Once your business has transitioned to EOT ownership, our team can also provide ongoing compliance support and administration to ensure your EOT remains compliant. This service includes managing Companies House filings and any relevant HMRC registrations.

Speak to us about employee ownership trusts today

For advice on succession planning, to arrange an Employee Ownership Trust feasibility analysis for your company, or simply to find out more about Employee Ownership, please get in touch – Email – enquiries@rm2.co.uk

Relevant resources